Even if you choose Quicken, you might consider signing up for Empower, as well. With Empower you receive a picture of your current financial situation, help managing your investments and how your investing can be improved. Empower investment tracking is quite good.Īfter the signing up for Empower you gain access to the following investing-related reports:

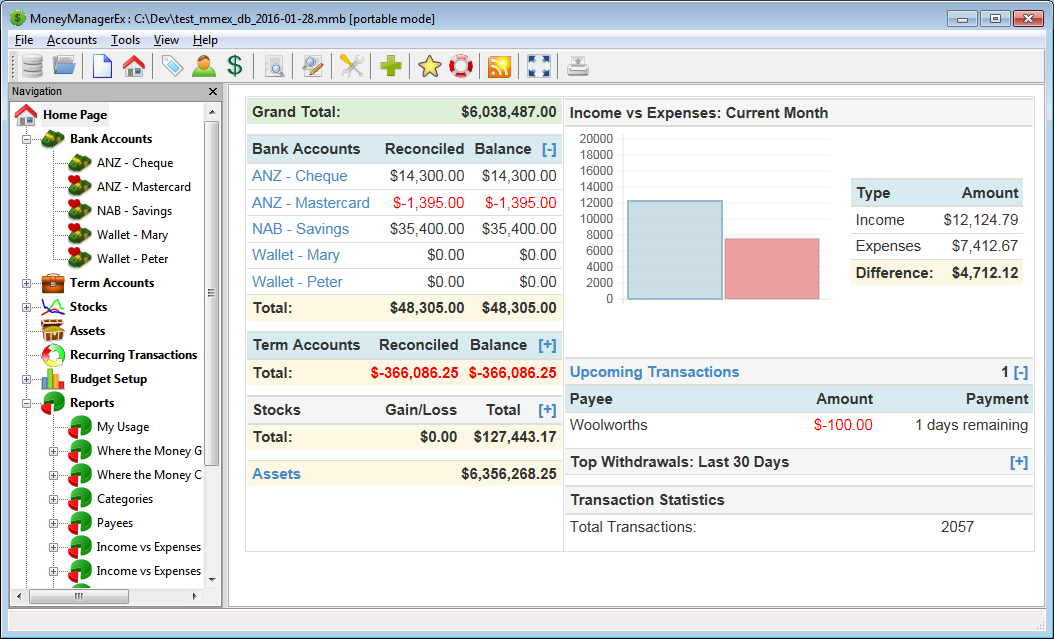

Empower -Investment TrackingĮmpower is better at automatic updating of accounts. While Quicken sends user control alerts, Empower gives real time financial updates. Empower – Apps Flexibility / User-Friendlinessīoth programs have their mobile application counterparts that will let you access your financial information on the go. We especially like the “You Index” that compares your returns with major benchmarks. Quicken’s dashboard is more comprehensive on the spending and budgeting items, while Empower focuses heavily on investment-related data. Compares your investment returns – You Index – with those of major market indexes in market movers section.Graphs 90-day investment portfolio growth.Next, several instances where the dash boards vary. expenses.īoth platforms show 30-day spending by account. While the time period is adjustable on Quickenīoth platforms show cash flow information – monthly income vs. The account values are automatically updated on Empower, while on Quicken, to get current account values, you need to click the “update” icon.īoth platforms show your net worth figure, although Empower also shows a 90-day net worth graph. Quicken users can customize the time period for each category and encompasses spending, saving and investing details.īut don’t count Empower out. That includes bank, investment, credit card, debt and asset (like your home) values. While, both the Quicken and Empower dashboard’s show all account listings on the dashboard. Quicken inched out Empower with customizable tiles and broader options.

Although it’s added effort, it’s worth the financial information protection.

At both Empower and Quicken linking and syncing accounts is fast and accurate.ĭue to security upgrades, both platforms might request you to reconnect a financial account. Small business and real estate trackingĪlthough Empower used to be the winner in this category, Quicken has improved it’s capacity to link all accounts.Banking, credit card, investment, and debt tracking.Quicken has various plans and charges an annual subscription fee.

#MONEY MANAGER EX V PERSONAL CAPITAL SOFTWARE#

Quicken is money management software that’s been around for 30+ years. This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. Empower – Apps Flexibility / User-Friendliness

0 kommentar(er)

0 kommentar(er)